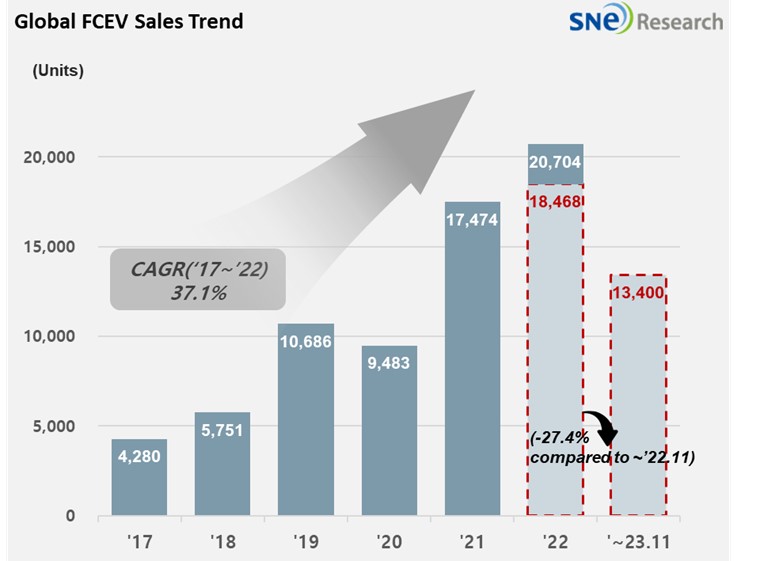

From Jan to Nov 2023, Global FCEV Market with a 27.4% YoY Degrowth

- Hyundai Motor Group took up 36.4% of the global FCEV Market

A total number of globally registered FCEVs sold from Jan to November in 2023 was 13,400 units, recording a 27.4% YoY degrowth.

(Source: Global FCEV Monthly Tracker – December 2023, SNE

Research)

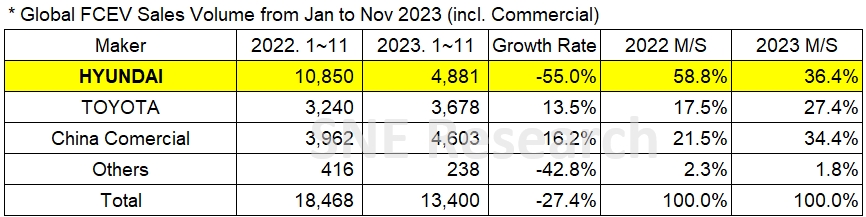

By company, Hyundai Motors sold 4,881 units of NEXO and ELEC CITY, remaining at the top on the list with its 36.4% of market share. While Hyundai saw 10,700 units of NEXO sold in the same period of last year, taking up the overwhelmingly big market share, but this year it only saw 4,601 units of NEXO sold, a 55.0% YoY decline. On the other hand, the sale of Toyota Mirai enjoyed a 13.5% YoY growth from 3,238 units to 3,678 units. The Chinese companies have been in an upward trend, mostly focusing on the commercial vehicle market.

(Source: Global FCEV Monthly Tracker – December 2023, SNE

Research)

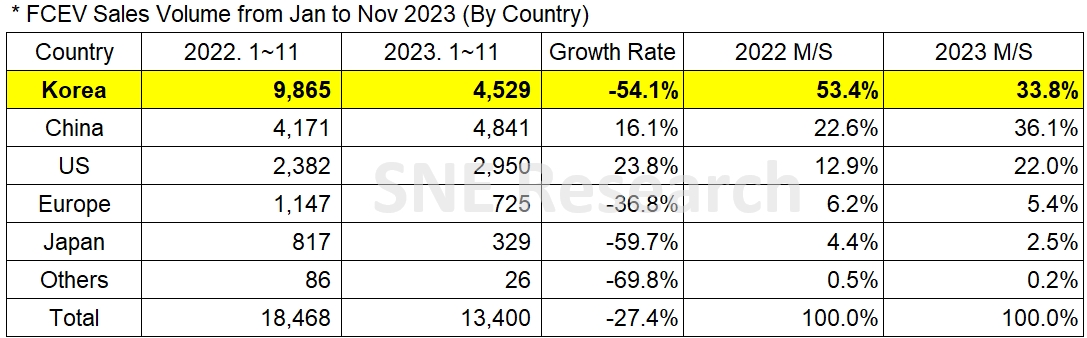

By country, due to the impact from declining sales of NEXO, Korea experienced a 54.1% YoY decline in sales. Chia recorded a continuous growth mainly in hydrogen commercial vehicles, taking the top position not only on the list of global EV market share but also the FCEV vehicle market share. The US, where Toyota’s Mirai with a YoY growth was sold most, also recorded a growth.

(Source: Global FCEV Monthly Tracker – December 2023, SNE

Research)

Since

2018, when Hyundai first unveiled NEXO, the global FCEV market continued to be

in an upward trend with the global annual sales exceeding 20,000 units, but the

2023 FCEV market is expected to close with overall degrowth throughout the

year. The major reason for such degrowth is that the FCEV sales in Korea, which

took up the biggest market share, significantly dropped more than by half

compared to the same period of last year. Since 2018, the NEXO model only had two

facelift models in 2021 and 2023, offering a limited option to consumers. In addition

to that, due to the increasing charging cost of hydrogen car, defective

hydrogen incidents, and hydrogen charging infrastructure shortage, it has

become inevitable for FCEVs to lose its lusters in the eco-friendly vehicle

market. On the other hand, the Chinese government has been accelerating the commercialization

of hydrogen energy in China by actively expanding the distribution of hydrogen

cars and establishing the related infrastructure through the China’s Medium and

Long-Term Strategy for the Development of the Hydrogen Industry (2021-2035). The

Chinese government has rapidly expanded its FCEV market share by taking

advantage of its hydrogen commercial vehicle market. While it is expected that

hydrogen commercial vehicles would be one of the major parts of hydrogen economy

in future, attentions should be paid to changes in the landscape of competition

between major companies who invest in the fuel cell system.